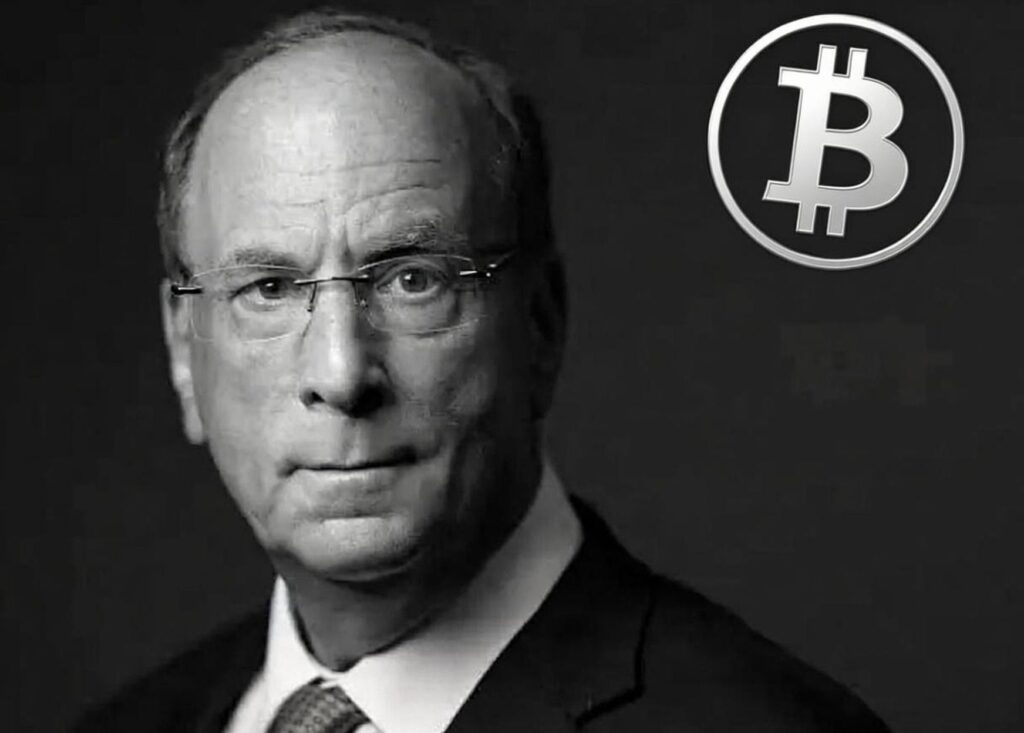

In a sobering interview at the New York Times DealBook Summit on 3 December 2025, BlackRock CEO Larry Fink has eaten humble pie and bowed to the undeniable rise of Bitcoin. Speaking alongside Coinbase CEO Brian Armstrong, Fink reflected candidly on his past scepticism. He conceded, “I was wrong about Bitcoin and crypto in earlier views,” a full reversal from his days of outright dismissal.

BlackRock now holds one of the world’s biggest Bitcoin ETFs, the iShares Bitcoin Trust (IBIT). As of 3 December 2025, it boasts net assets of a staggering $72.3 billion, making it the firm’s most profitable product and the largest spot Bitcoin ETF globally. Just eight years earlier, on 13 October 2017, Fink had damned Bitcoin as an “index of money laundering,” claiming its explosive growth merely highlighted “how much demand for money laundering there is in the world.” Back then, Bitcoin traded around $4,000. Today, in early December 2025, it hovers at approximately $92,917, with its market cap ballooning past $1.8 trillion.

Yet, despite the writing on the wall, BlackRock’s CEO never publicly admitted his mistake until now. He instead circumvented it, much as successive US administrations have skirted the Epstein files. This confession is welcome.

The latest financial mammoth to dip its toes in is Charles Schwab, the brokerage behemoth overseeing more than $11.59 trillion in client assets. During its third-quarter earnings call in mid-October 2025, Schwab CEO Rick Wurster confirmed plans to roll out direct spot trading for Bitcoin and Ethereum to its vast client base in the first half of 2026. This signals a bold pivot from a firm once synonymous with staid stock picks to one embracing digital assets head-on.

This shift isn’t happening in a vacuum. Institutional adoption has exploded. Bitcoin ETFs alone drew $870.7 million in fresh institutional holdings during Q3 2025, up $117.3 million from the prior quarter.

The total crypto market cap breached $4 trillion for the first time in July 2025. This was driven by regulatory tailwinds and blockchain’s proven utility beyond mere speculation, from cross-border payments to decentralised finance.

This comes hot on the heels of a closed-door White House dinner on 12 November 2025, hosted by President Donald J Trump. There, Fink rubbed shoulders with fellow finance heavyweights under informal Chatham House-style rules, keeping the chats off the record but ripe for influence. Attendees included JPMorgan Chase CEO Jamie Dimon, Goldman Sachs’ David Solomon, Morgan Stanley’s Ted Pick, Blackstone’s Stephen Schwarzman, and Nasdaq’s Adena Friedman.

Critics like Fink in his 2017 heyday dismissed it all as nefarious folly. But facts don’t lie: Bitcoin’s blockchain has processed over 1 billion transactions since inception. Even gold bugs are taking note. So, if you are one of the old guard who took a stark view of Bitcoin and are too proud to backtrack, do not be. Even the CEO of one of the world’s largest funds has eaten his humble pie.