Crypto has, for the most part, been a medium of value that can be stored for a return and then transferred to fiat for the payment of goods and services. Some organisations, over time, have made certain products payable in Bitcoin or Dogecoin, but these have largely been high-end luxuries and have not met the demands of day-to-day purchases and utility. As a result, crypto apps have not significantly challenged traditional banks as a place to hold money, since they have lacked the everyday spending utility that people still rely on banks for.

However, this is now changing. Adoption across crypto wallets and custodians is accelerating. Mastercard now offers a crypto-backed card through partners such as Gemini, OKX, and MoonPay, to name a few.

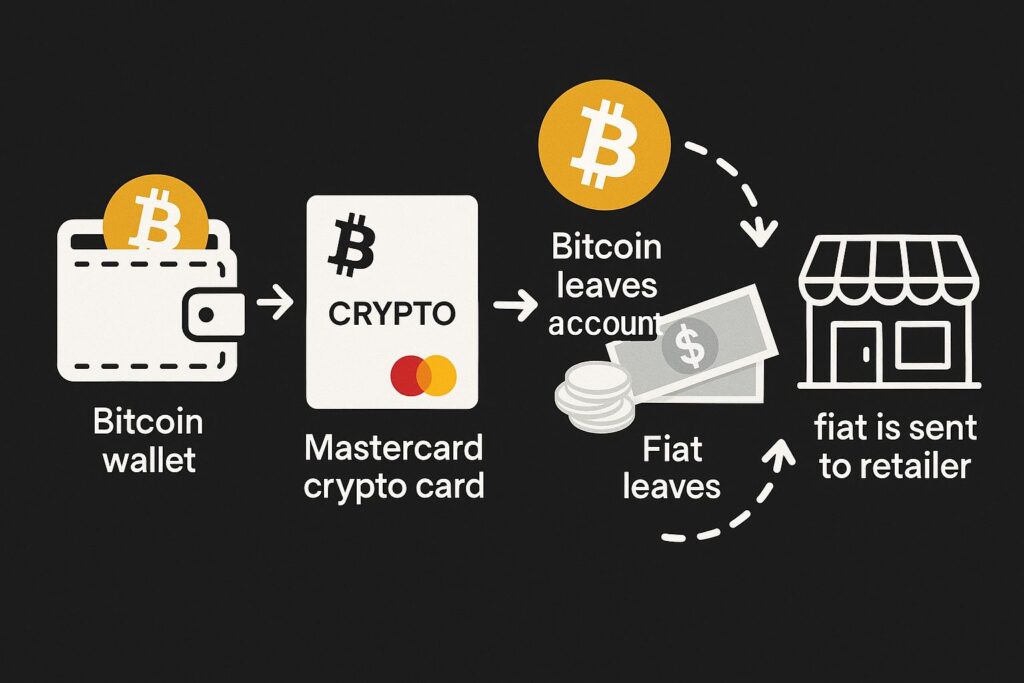

This means you can now live your life using Bitcoin, hold no fiat currency, and simply make day-to-day purchases directly through your Bitcoin holdings. Think about that: you no longer need to hold fiat! Of course, for this to work—given that not every business has magically acquired the capability or willingness to accept Bitcoin for goods and services—your Bitcoin is converted into fiat at the point of purchase, which is then paid to the retailer. It’s quite a simple and elegant solution, allowing you to choose crypto DeFi banks over traditional banks, without requiring retailers to accept crypto themselves.

How it works:

Bitcoin wallet → Mastercard crypto card → Bitcoin leaves account → Bitcoin converted to fiat → Fiat is sent to retailer.

So, given historic levels of distrust in traditional banking and the fact that most core banking utilities are now being replicated by crypto wallets, is it possible that Gen Alpha will forgo conventional banks in favour of a purely on-chain financial system?

Historically, the shift from centralised to decentralised finance was held back by the limited utility of crypto in the real world and the inability to make everyday purchases. But that has changed, making mainstream banks appear less relevant and accelerating the move towards fully decentralised finance.

Case Use Example: Inflation

If you placed £5,000 in a bank 20 years ago with a nominal interest rate, the value of that money would have decreased by around 44.3% due to inflation—equivalent to a loss of £2,216 in purchasing power. That means you’ve effectively lost almost half your spending value by simply keeping your money in a current account.

Now, most people would likely put long-term savings into an interest-bearing account. Let’s examine that. Assuming an average interest rate of 2% per annum (compound), your £5,000 would grow to £7,429 after 20 years.

However, if inflation has made prices on average 79.6% higher than in 2005 according to https://www.ons.gov.uk/economy/inflationandpriceindices, your purchasing power is still £863 worse off than when you started. So while your money increased on paper, its real-world value declined.

In other words, keeping your money in the fiat system might feel safe, but over time, inflation silently reduces the actual value of your savings. You end up with more money numerically, but less purchasing power—meaning your money is worth less than when you first saved it.

Conclusion

Banks may still play a role in the short term, but for long-term financial planning, you should consider alternatives such as a SAP fund, a pension fund, stocks, or cryptocurrency. Idle cash left in a current or low-interest savings account is vulnerable to inflation and may leave you with less value over time—even if the number in your account goes up.