Michael Saylor is a Bitcoin guru, from headlining the Bitcoin Conference to appearing on Jordan Peterson’s podcast and news outlets. The viral “Baby Saylor” meme, depicting him as a HODL icon, underscores his prominence. MicroStrategy’s Bitcoin treasury, holding 582,000 BTC, proves the power of commitment and holding through volatility, as well as demonstrating resilience in business. The now 60-year-old Bitcoin guru has scaled the heights of commercial success, only to see it all come crashing down and then rebuild from the rubble. Saylor can best be categorised as adaptable and relentless but, above all, pragmatic. Through this, he has consistently looked ahead, seen where value will be created, and got in on the ground floor. From business intelligence (BI) to Bitcoin, once he identifies the most valuable future, he doubles down on it.

The Man Behind the Viral Baby Saylor Meme

Saylor co-founded MicroStrategy in 1989 with MIT classmate Sanju Bansal. In 1992, a $10 million USD McDonald’s contract to analyse promotions pivoted the company from data mining to business intelligence (BI). The 1998 IPO (3 million shares at $12) doubled to $24 on day one, hitting $100 by late 1999 and $333 by March 2000, with a $13.54 billion market cap. Forbes named Saylor Washington, D.C.’s richest man, with a $7 billion net worth. Life was good for a young Michael Saylor, but his astronomical success and soaring incline would all come crashing down due to accounting errors.

It wasn’t all Plain Sailing

In 2000, an SEC fraud charge for inflated revenues crashed the stock from $333 to $4.50 by late 2000, shrinking the market cap to ~$138.6 million, a far cry from the $13.54 billion market cap of its heyday. Eventually, Saylor settled for $8.3 million, stayed CEO, and rebuilt MicroStrategy’s reputation, reviving MicroStrategy into a competitive BI firm through a focus on mobile and cloud-based BI products and data warehousing, competing with the likes of Microsoft Power BI.

The $250 Million Bitcoin Bet

However, the BI market became increasingly saturated, and top firms vied for business, making it a less viable long-term bet for the business and to deliver the type of astronomical value shareholders had come to expect from Saylor. This resulted in the single most consequential decision the business would ever make: creating a Bitcoin reserve by investing $250 million of cash reserves to purchase 21,454 BTC at ~$11,600/BTC (today it stands at $106,000). It wasn’t long until the focus of the business shifted entirely to a Bitcoin treasury, and common shares were issued for investment into the Bitcoin strategy, sending MicroStrategy’s share price sky-high. (Today, MicroStrategy’s share price eclipses the dot-com boom at $383.03.) A colossal share price when you consider the tech side of the business is in the red! Generating revenue of $450 million this year, it is still $100–200 million in the red and predicted to remain unprofitable until 2028 due to high levels of investment in R&D and cloud migration. MicroStrategy is predominantly valued for its Bitcoin treasury these days.

The Strategy ?

The beauty of MicroStrategy lies in its simplicity: the business issues new common shares to raise funds to purchase more Bitcoin, no different from how a business may issue new shares to fund expansion. Although using a share structure to purchase an asset like Bitcoin is unusual, it offers some distinct advantages. This strategy transformed a $1.5 billion company into a $109.27 billion Bitcoin proxy, up 7,185% since July 2020.

21/21

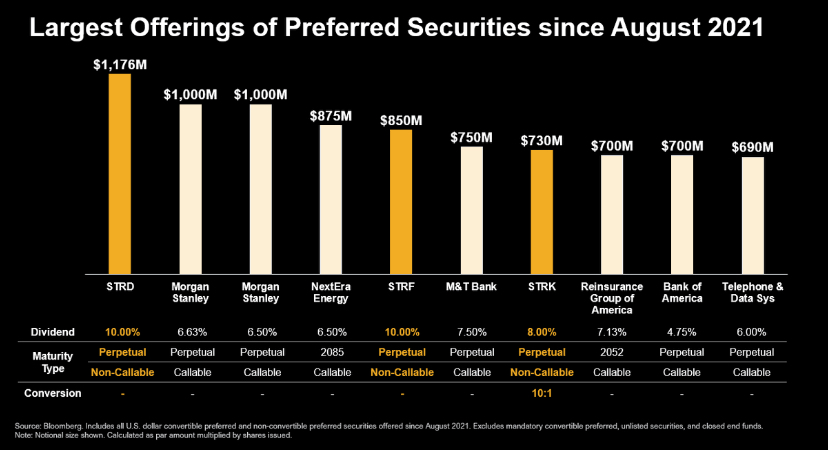

Moving forward MicroStrategy seems to be vying towards being a leader in the bitcoin fixed income backed securities space out pacing Morgan Stanely and Bank of America in their offering of prefered securities since 2021. Debt instruments, including convertible notes and preferred stock, are a part of MicroStrategy’s ambitious 21/21 Plan to raise $42 billion, with $21 billion from fixed income securities and $21billion from additional stock offerings.

What’s the upside ?

Bitcoin ownership through a share proxy has many upsides, which one might want to consider when choosing to invest through a share proxy. Here are a few:

- Bitcoin Exposure: Shares capture MicroStrategy’s $25 billion unrealised Bitcoin gains and future upside.

- Regulatory Ease: Avoids direct crypto ownership rules.

- Security: Leverages MicroStrategy’s cold storage, mitigating risks like 2024’s $2.2 billion in crypto hacks.

Conclusion

If you are going to bet on a cryptocurrency, why not let it be the one that the man who lost billions bet on and made them back through a Bitcoin treasury? Fortune favours the bold, as Michael Saylor has shown us all. Whether you are a retail investor or seeking custodian services, the Moneybrain team can help you ensure that, like Saylor, you can bet big on Bitcoin and win big, before its next astronomical rise. MicroStrategy’s secure storage (cold wallets, multi-signature) protects its Bitcoin treasury. Saylor’s gambit proves HODL wins.

Moneybrain Jargon Buster

We try to keep our articles jargon-free, but sometimes it’s difficult to escape technical terms without becoming too wordy! So, we’ve put together a Jargon Buster for terms we use in this article that might need a second glance:

Bitcoin Treasury

A strategy where a company holds Bitcoin on its balance sheet as a reserve asset, similar to how firms hold cash or gold.

HODL

A slang term in the crypto community meaning to “hold on for dear life”, keeping your cryptocurrency despite volatility, rather than selling.

Cold Storage

An offline method of storing cryptocurrency, protecting it from hacks and cyberattacks.

Multi-signature (Multi-sig)

A type of wallet security that requires multiple parties to approve a transaction before it can be executed, reducing fraud or theft risk.

Convertible Notes

Debt instruments that can convert into equity (shares) in the issuing company under certain conditions, often used to raise capital.

Preferred Stock

A class of ownership in a company that has a higher claim on assets and earnings than common stock, often with fixed dividends.

Fixed Income Securities

Investments that provide regular, set returns (like bonds), used by firms to raise funds with predictable repayment terms.

Share Proxy for Bitcoin

Buying shares in a company like MicroStrategy to gain indirect exposure to Bitcoin price movements, without owning Bitcoin directly.

Regulatory Ease

The benefit of avoiding complex rules and compliance associated with directly holding cryptocurrencies.

Unrealised Gains

Profit on assets that have increased in value but haven’t been sold yet, meaning the gains exist only on paper.

Bitcoin-Backed Securities

Financial products (like bonds or preferred stock) supported by Bitcoin holdings rather than traditional assets or revenue streams.