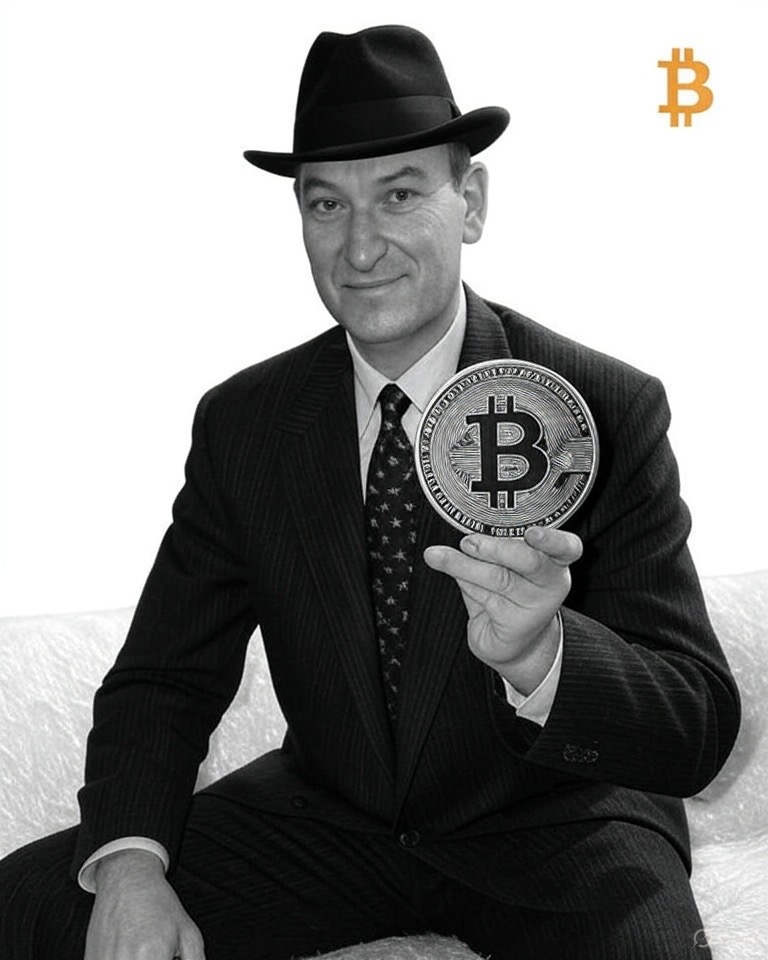

The Trump Administration is doubling down on its vision for a “golden age of crypto” with the appointment of Paul S. Atkins as the 34th Chairman of the U.S. Securities and Exchange Commission (SEC). Sworn in on 21 April 2025, Atkins brings decades of regulatory experience and a proven track record to the role, reinforcing the administration’s commitment to fostering innovation in cryptocurrency and digital assets.

Widely regarded as the “Godfather of Republican Capital Markets Policy” Atkins is a seasoned SEC veteran. During the 1990s, he served under Chairmen Richard C. Breeden and Arthur Levitt, rising to the role of Chief of Staff and Counsellor. Later, from 2002 to 2008, he served as an SEC Commissioner under President George W. Bush, championing policies that promoted market efficiency, transparency, and greater access to capital for investors.

With deep institutional knowledge and a forward-looking vision, Atkins is well-positioned to lead the SEC through a new era of digital finance. His personal investment of approximately $6 million in crypto-related assets (excluding Bitcoin) demonstrates a hands-on understanding of the sector’s potential and challenges. (Atkins has pledged to divest from these investments within 120 days of his confirmation to comply with ethics rules.) Perfectly aligning with the administration’s pro-crypto stance. His appointment sends a strong signal: the United States intends to lead globally in the crypto and digital asset space.

A New Era of Crypto-Friendly Policy

Atkins’ appointment is a key component of a wider, transformative agenda under the Trump Administration to usher in a so-called “golden age of crypto.” The United States is seeking to redefine global standards in cryptocurrency, marking a decisive shift from centralised financial systems to a more decentralised and innovation-led future. Several new policies and reforms underpin this direction:

- End of Operation Choke Point

The Trump Administration has formally ended Operation Choke Point and its successor, Choke Point 2.0, initiatives that previously stifled crypto innovation via indirect banking restrictions. These programmes imposed disproportionate regulatory burdens on crypto start-ups, favouring centralised alternatives like CBDCs. Their removal paves the way for a more open and competitive decentralised finance ecosystem. - Establishment of a U.S. Crypto Reserve

A new national Crypto Reserve has been announced, consisting of a diversified portfolio of digital assets including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA). This strategic reserve underscores growing institutional confidence in crypto’s long-term value and positions digital assets as integral to the future of the financial system. - Federal Reserve Eases Crypto Reporting Requirements

In a further shift, the Federal Reserve has withdrawn previously strict reporting rules that applied to banks dealing with cryptocurrencies. This deregulatory step lowers barriers to mainstream institutional adoption and is expected to help stabilise established crypto markets over time. Crucially, it also diminishes the prospects of a state-controlled digital currency by enabling greater private-sector participation. (Read more about our views on CBDCs: Are CBDCs Central Banking Digital Currencies Dead in the Water?.

This pro-innovation stance is driving significant levels of investment into the United States from both domestic and international players. Technology giants such as SoftBank, TSMC, and Apple are reportedly committing hundreds of billions to capitalise on this new, innovation-friendly regulatory environment, one that prioritises the future over the past.

Outlook and Conclusion

The Trump Administration’s broader agenda remains focused on “draining the swamp,” characterised by uncovering entrenched inefficiencies and dismantling systemic fraud across federal agencies. These actions are projected to generate substantial savings, with a goal of up to $1 trillion per year in waste and fraud by the end of the current term. Approximately £150 billion of these savings have already been realised.

Alongside these efforts, there is a renewed emphasis on repatriating manufacturing capacity, revitalising American industry, and resisting the adverse effects of unchecked globalisation. These efforts, combined with a robust pro-crypto policy framework, aim to make digital assets mainstream and irreversible, undermining legacy centralised systems and empowering a more decentralised and participatory financial future.

In short, the appointment of Paul Atkins marks not just a personnel change at the SEC but a clear inflexion point in American financial policy, where innovation, sovereignty, and decentralisation are firmly at the centre.