We live in a decade poised to be the industrial revolution of our time, with artificial intelligence growing smarter and more sophisticated by the day. Data centers are expanding at an unprecedented scale, and self-driving cars and autonomous robots are on the horizon. It’s fair to say this decade will redefine our era, much like past industrial revolutions. With every such transformation, monetary systems bend and adapt to accommodate the dynamism of progress. So, the question arises: will fiat currency be a casualty of the coming “technological revolution”? While the writing isn’t yet clearly on the wall, there are signs we ignore at our peril.

Could DOGE Save the U.S. Reserve Currency Status?

The scenario feels like a plot twist from Matrix Resurrections, where Neo is reinserted into the Matrix as the designer of a wildly successful game within the simulation itself. Similarly, envision Elon Musk in the Trump administration, leveraging DOGE, not the meme coin but the Department of Government Efficiency to preserve the dollar’s dominance as the world’s reserve currency. It’s a bizarre, almost surreal reset: a concept born from a cryptocurrency joke morphing into a governmental task force aimed at rescuing the U.S. from the historic debt appetite of past administrations.

Debt Appetite

It’s important to note that DOGE bears resemblance to plans announced by Barack Obama in his first term, when the U.S. national debt was already seen as a pressing issue. When Obama entered the White House on January 20, 2009, the national debt stood at approximately $10.6 trillion, and cutting waste was a paramount concern, until it wasn’t. This shift became evident during Obama’s second term. Over his first term (2009-2013), the debt grew from $10.6 trillion to $16.4 trillion, an increase of $5.8 trillion. By the end of his second term in January 2017, the debt reached $19.9 trillion, reflecting a further rise of $3.5 trillion over those four years or a total increase of $9.3 trillion across his eight years in office.

When Donald Trump took office on January 20, 2017, the debt he inherited was $19.9 trillion. The Trump administration saw significant debt growth, reaching $27.7 trillion by January 20, 2021 a total increase of $7.8 trillion over his term. Of this, approximately $3.3 trillion was tied to COVID-19 relief efforts in 2020, accounting for about 42% of the accumulated debt during his four years. Excluding COVID and obligations from previous administrations, Trump’s administration added around $1.1 trillion through its own policies. This cumulatively brought the debt to $27.7 trillion at the beginning of the Biden administration. The Biden administration saw another staggering debt increase of $8.5 trillion, bringing the total national debt in the U.S. to $36.2 trillion when he left office on January 20, 2025. Although it’s important to note that 0.42 Trillion of Biden’s debt would have been inherited from the Trump Administration defence and domestic policies as would TCJA (Tax Cuts and Jobs Act of 2017) making for a 1.4T carry-over.

| Administration | Inauguration | Start Debt (T$) | End Debt (T$) | Increase (T$) | Notes |

| Obama | Jan 20, 2009 | 10.6 | 19.9 | 9.3 | $5.8T first term, $3.5T second term |

| Trump | January 20, 2017 | 19.9 | 27.7 | 7.8 | $3.3T COVID (42%), 3.5T carry over from Obama, $1.1T own policies |

| Biden | Jan 20, 2021 | 27.7 | 36.2 | 8.5 | $8.5T increase, 0.42T carry over from Defense and Domestic Polices 0.62T TCJA loss from Trump |

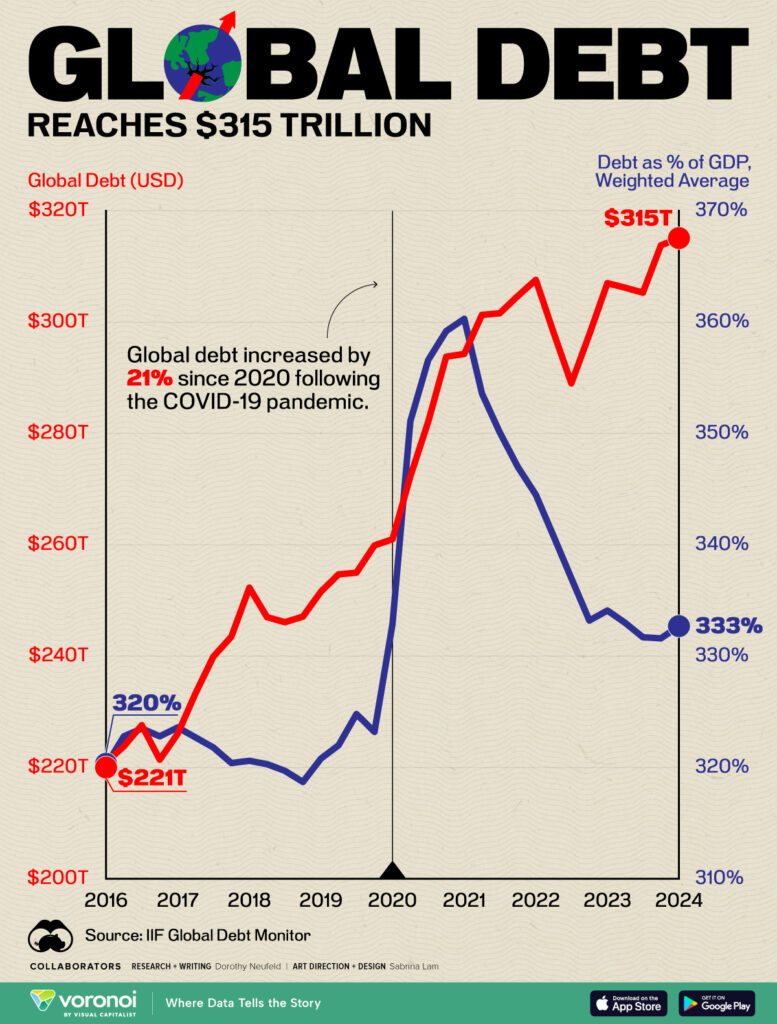

Global Debt Picuture

The trend of debt appetite is global but has been hastened and emboldened by the U.S., as the world’s reserve currency, willingly raising its own national debt to $34.832 trillion at the time of the IIF’s Global Debt Monitor report. This represented 38.28% of the total global government debt of $91 trillion, with the remaining $224 trillion accounted for by household and corporate debt. This is an interested picture and important to understand before we dive into Ray Dalio’s predictions of the first and second order of impact and responses to proposed tariffs announced on America’s Liberation Day.

America’s Liberation Day and Tariffs

April 2nd marked a new National Liberation Day for America, coinciding with the announcement of broad, far-reaching tariffs that even the penguins of Heard and McDonald Islands (an Australian territory) couldn’t escape. This response reflects the U.S., as the world’s historical trading power, having long permitted unfavorable trade agreements, relying instead on printing money and growing the deficit to support a more globally equalized economy rather than a shrewd business strategy that keeps America in the black. This is evident in the historic debt appetites of Democratic administrations, and while equalization may seem a noble pursuit, it weakens the world reserve currency, which underpins the debt-fueled system enabling these skewed trade deals to pass muster in previous adminstrations.

Unsurprisingly, the U.K. was among the lowest, with only a 10% tariff placed on its trade, likely signaling the U.S.’s willingness to create a mutually favorable trade agreement. This follows positive remarks from President Trump about America becoming an associate member of the Commonwealth, driven by the President’s admiration for King Charles and the British Royal Family, as well as a desire to strengthen the West and retain dollar dominance or perhaps to establish a new economic order, possibly one of a crypto nature ?

View’s from Main Finance Player’s

Financial guru Ray Dalio has shared insights on the potential impact of these trade tariffs, emphasizing that a balance must be struck, which the U.S. will achieve from a position of strength. The more trade agreements negotiated with international powers like the U.K., the greater negotiating leverage the U.S. gains when seeking favorable trade deals with Europe and beyond. As the world’s reserve currency, it’s in the interest of other trading powers to negotiate on favorable terms with the U.S. to avoid economic stagnation due to reduced trade. A trade deal with President Xi Jinping of China would also be a significant achievement for the U.S., enhancing its position at the negotiating table with Europe and other regions.

Ray Dalio’s order predictions (succint version)

Tariffs are taxes that:

- Raise revenue for the imposing country, paid by foreign producers and domestic consumers based on their elasticities, making them an attractive tax.

- Reduce global production efficiency.

- Are stagflationary globally, more deflationary for the tariffed producer, more inflationary for the imposing importer.

- Protect domestic companies from foreign competition, reducing efficiency but aiding survival if demand holds via monetary and fiscal policy.

- Ensure production capabilities during great power conflicts.

- Reduce current and capital account imbalances, lessening reliance on foreign production and capital, especially in geopolitical conflicts.

Second-order effects depend on:

- Tariffed countries’ responses (e.g., reciprocal tariffs causing broader stagflation).

- Currency rate shifts.

- Central banks’ monetary policy adjustments (easing where deflationary, tightening where inflationary).

- Governments’ fiscal policy changes (easing for deflation, tightening for inflation), offsetting some effects.”

With the Trump Administration goal for reducing the defecit the tarrif playbook is one that will likely assist to this end and phase 2 of using the tarrfied position to negotiated favourble longer term trade deals with key economic powers will likely result in wide spread economic prosperity for the U.S. formost and early adopters of trade deals such as the United Kingdom and it’s Crown Teritories. The alternative is a sharp and hasty switch to bitcoin becoming the reserve currency as oppposed to a strategic unitive and measured shift into to digital assets over a cycle period outlined by Larry Fink CEO of Blackrock outlines in his quote

Larry Fink CEO of Blackrock

If the U.S. doesn’t get its debt under control. If the deficits keep ballooning, America risks losing that position [world’s reserve currency] to digital assets like Bitcoin America risks losing that position (dollar reserve status) to digital assets like Bitcoin.

The Trump administration’s push to embrace stablecoins over CBDCs (Stable Coins Market Cap $235-$238 Billion) suggests a hedge against a looming crypto monetary reset, aiming to preserve U.S. dollar dominance. Rather than resisting decentralization, it declares, ‘Let’s shape the future on our terms for a golden age,’ not hiding until it strikes like a grim reaper with the final sickle of financial dominance like less bullish juridstictions.