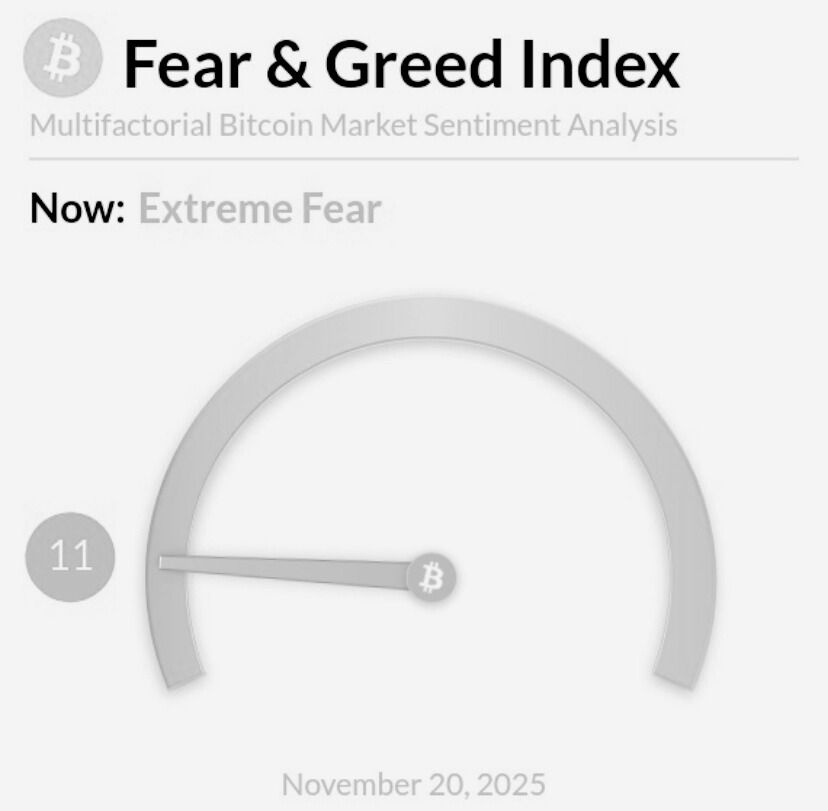

As of 20 November 2025, Bitcoin’s sitting around $92,000 after smashing its all-time high of over $126,000 back in early October 2025. That sharp drop from the peak has wiped out most of the year’s gains in a matter of weeks, plunging below $90,000 at one point and triggering over $1 trillion in broader crypto market losses. It’s enough to make any holder sweat, with retail traders liquidating billions in positions amid extreme fear – the Fear & Greed Index has hit rock-bottom levels not seen since the darkest days of previous bear phases. But here’s the thing: Bitcoin isn’t a get-rich-quick scheme for the faint-hearted. It’s always played the long game, rewarding those who zoom out beyond yearly swings and focus on the multi-year trajectory of 5 or more…

What’s changed fundamentally since the wild days of 2017 or even 2021 is the sheer level of legitimacy Bitcoin now enjoys. Institutional capital has flooded in, turning it into a proper asset class rather than a fringe gamble. Spot Bitcoin ETFs alone have pulled in tens of billions in net inflows throughout 2025, with giants like BlackRock, Fidelity, and others hoovering up coins even during this dip – year-to-date ETF assets under management are pushing towards $150 billion in some estimates. Companies like MicroStrategy continue stacking sats relentlessly, while on-chain data shows whales and long-term holders largely refusing to sell. Compare that to the 2018 crash, when there was zero institutional backstop; today, these big players provide a floor that makes deep, prolonged bears far less likely.

Looking ahead, it’s conservative to expect Bitcoin to at least double from current levels over the next five years if it sticks to its historical post-halving pattern of turbulent but relentless upward growth. Halvings reduce new supply, ETF demand keeps absorbing what’s available, and broader adoption from potential sovereign reserves to everyday payment rails – only accelerates the scarcity story. Sure, macro headwinds like Fed policy shifts or geopolitical noise can sting short-term, but the fundamentals scream accumulation opportunity.

So hold tight to your Bitcoin, weather the storm, and reap the rewards down the line. In the spirit of the HODL mantra that’s served so well (and with a nod to the pro-crypto vibes echoing from certain high offices), So hold tight to your Bitcoin, weather the storm, In the words of President Donald J. Trump “Don’t be a Panican!